Daily technical analysis and forecast for 24 September 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 24 September 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market completed a decline to 1.1778. Today, 24 September 2025, growth to 1.1820 is expected as part of a correction to the previous downward wave at 1.1726. After this correction, a new decline towards 1.1717 is possible as the first target. Once this level is reached, another correction to 1.1800 (testing from below) is not excluded. Later, a third downward wave may develop towards 1.1540 as a local trend target.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 1.1800, which is considered key for EURUSD. At the moment, the market completed the local target of the decline wave. Today, a correction to the central line of the Price Envelope at 1.1820 is expected, followed by a decline towards its lower boundary at 1.1717.

Technical indicators for today’s EURUSD forecast suggest a move to 1.1717.

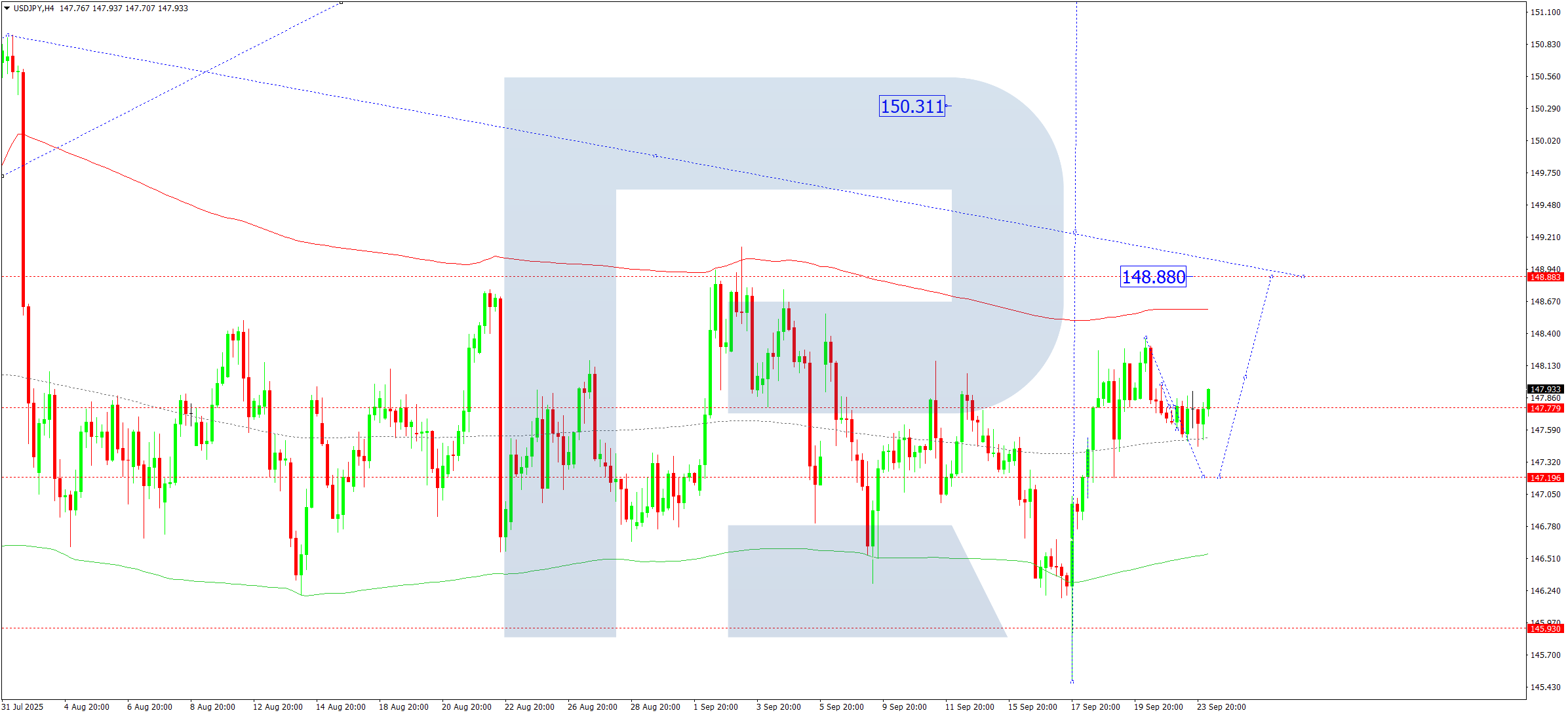

USDJPY forecast

On the H4 chart of USDJPY, the market is consolidating around 147.77, with the range extended down to 147.46 and up to 147.97. Today, 24 September 2025, another downward move to 147.17 is not excluded, followed by growth to at least 148.88.

Technically, this scenario is confirmed by the Elliott wave structure and the upward wave matrix with a pivot at 147.27, which is considered key in the structure of this wave. At the moment, the market is forming a growth wave towards the upper boundary of the Price Envelope at 148.88. Today, it is relevant to expect this target to be reached, followed by a correction towards the central line at 147.20.

Technical indicators for today’s USDJPY forecast suggest growth to 148.88.

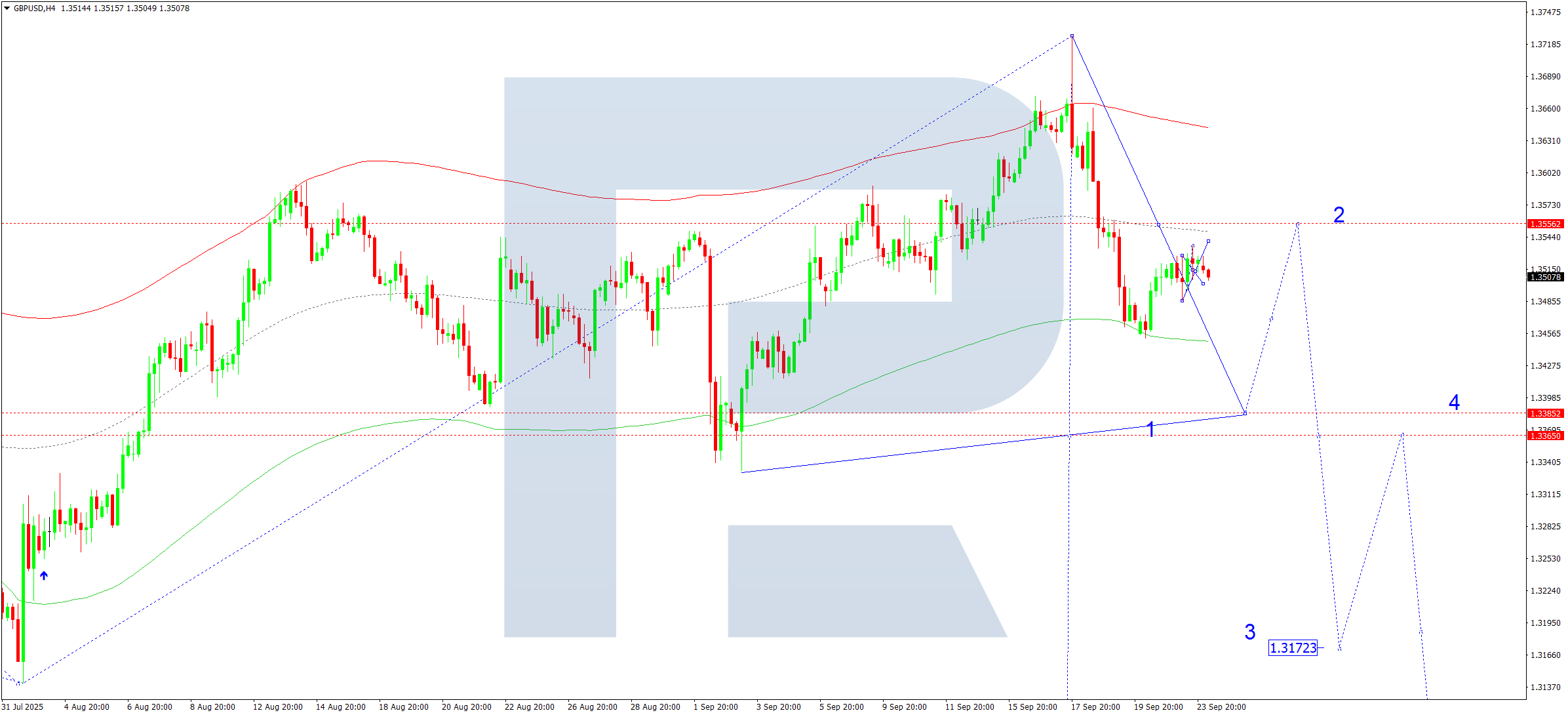

GBPUSD forecast

On the H4 chart of GBPUSD, the market continues consolidating around 1.3514. Today, 24 September 2025, a move to 1.3540 is not excluded. Later, a continuation of the decline towards 1.3385 is expected as the first target. After reaching this target, a correction to 1.3550 is possible, followed by another downward wave towards 1.3172 as a local trend target.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 1.3545, which is considered key in the structure of this wave. At the moment, the market is moving towards the lower boundary of the Price Envelope at 1.3385.

Technical indicators for today’s GBPUSD forecast suggest a decline to 1.3385.

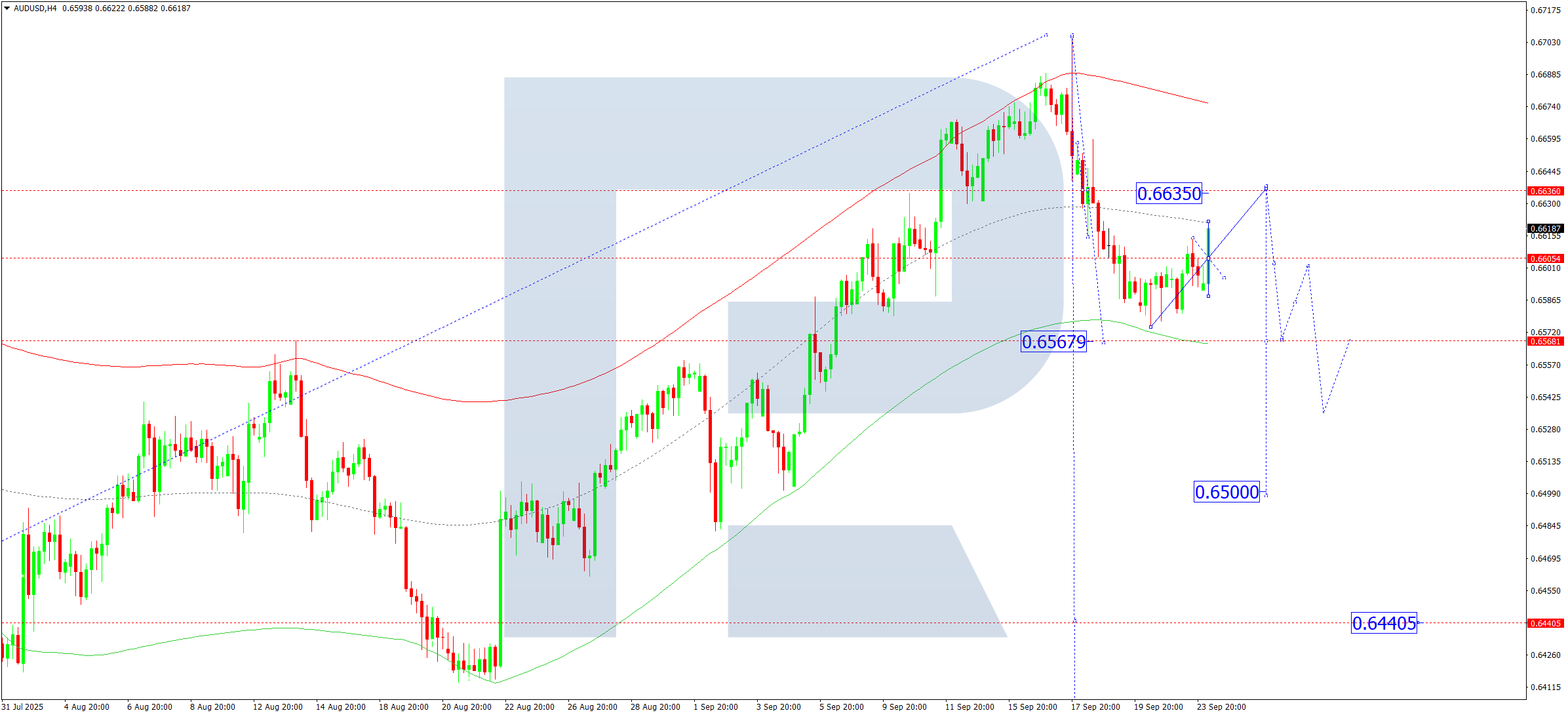

AUDUSD forecast

On the H4 chart of AUDUSD, the market formed a rise to 0.6614 and corrected to 0.6588. Today, 24 September 2025, it rose again to 0.6622. A decline to 0.6600 (testing from above) is expected, followed by another rise to 0.6635. This correction may extend to 0.6635, after which a new decline towards 0.6567 is likely as the first target. Later, another correction to 0.6635 is possible, followed by a decline to 0.6550. A breakout of this level may open potential for a downward wave to 0.6456 as a local trend target.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 0.6635, which is considered key for AUDUSD. At the moment, the market continues its decline towards the lower boundary of the Price Envelope at 0.6567. Today, reaching this level and then correcting to the central line at 0.6635 is relevant.

Technical indicators for today’s AUDUSD forecast suggest growth to 0.6635 and a decline to 0.6568.

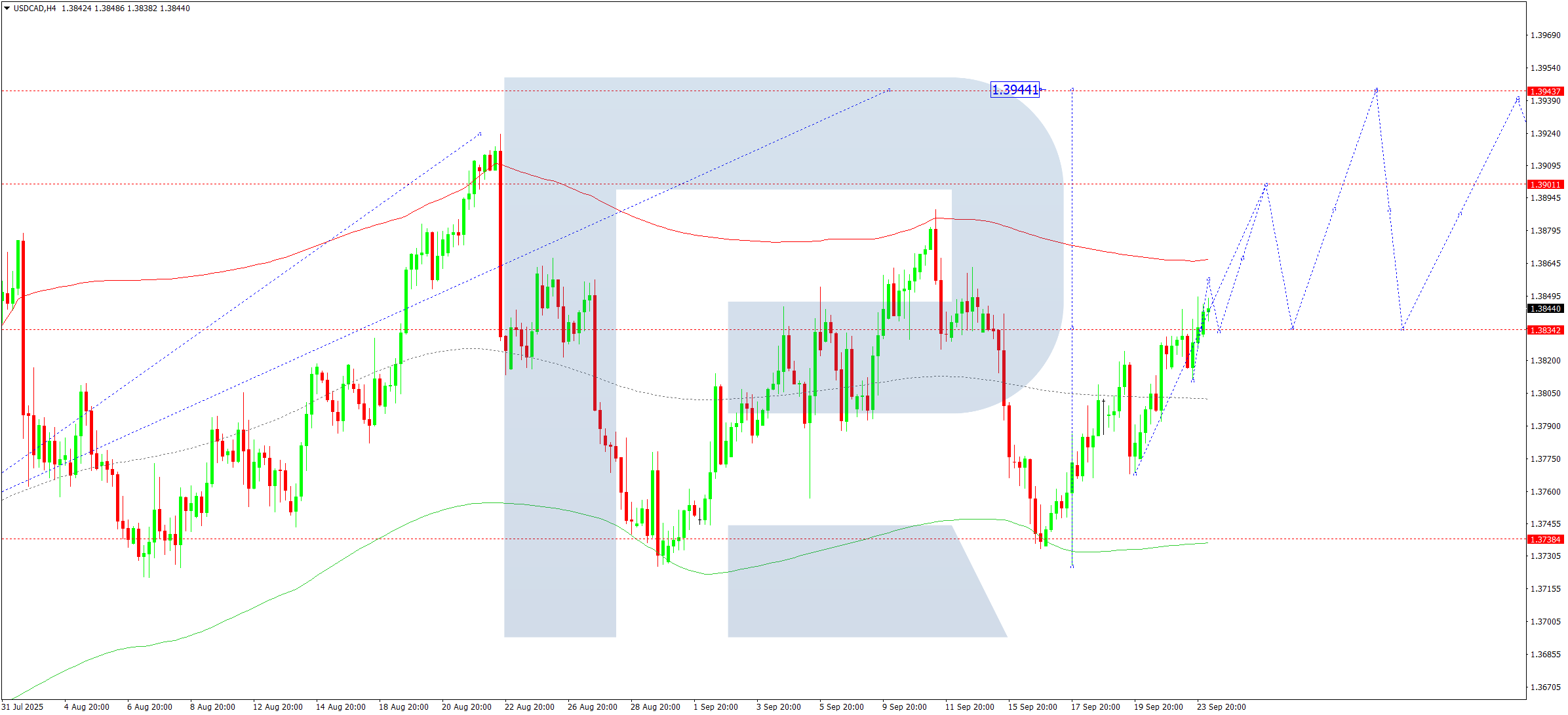

USDCAD forecast

On the H4 chart of USDCAD, the market consolidated around 1.3834. Today, 24 September 2025, the range may expand upwards to 1.3857 before correcting to 1.3834 (testing from above). Later, growth to 1.3900 is expected as a local upward trend target.

Technically, this scenario is confirmed by the Elliott wave structure and the upward wave matrix with a pivot at 1.3834, which is considered key in the structure for USDCAD. At the moment, the market is forming a wave towards the upper boundary of the Price Envelope at 1.3900. A correction to the central line at 1.3834 (testing from above) is also possible.

Technical indicators for today’s USDCAD forecast suggest growth to 1.3900.

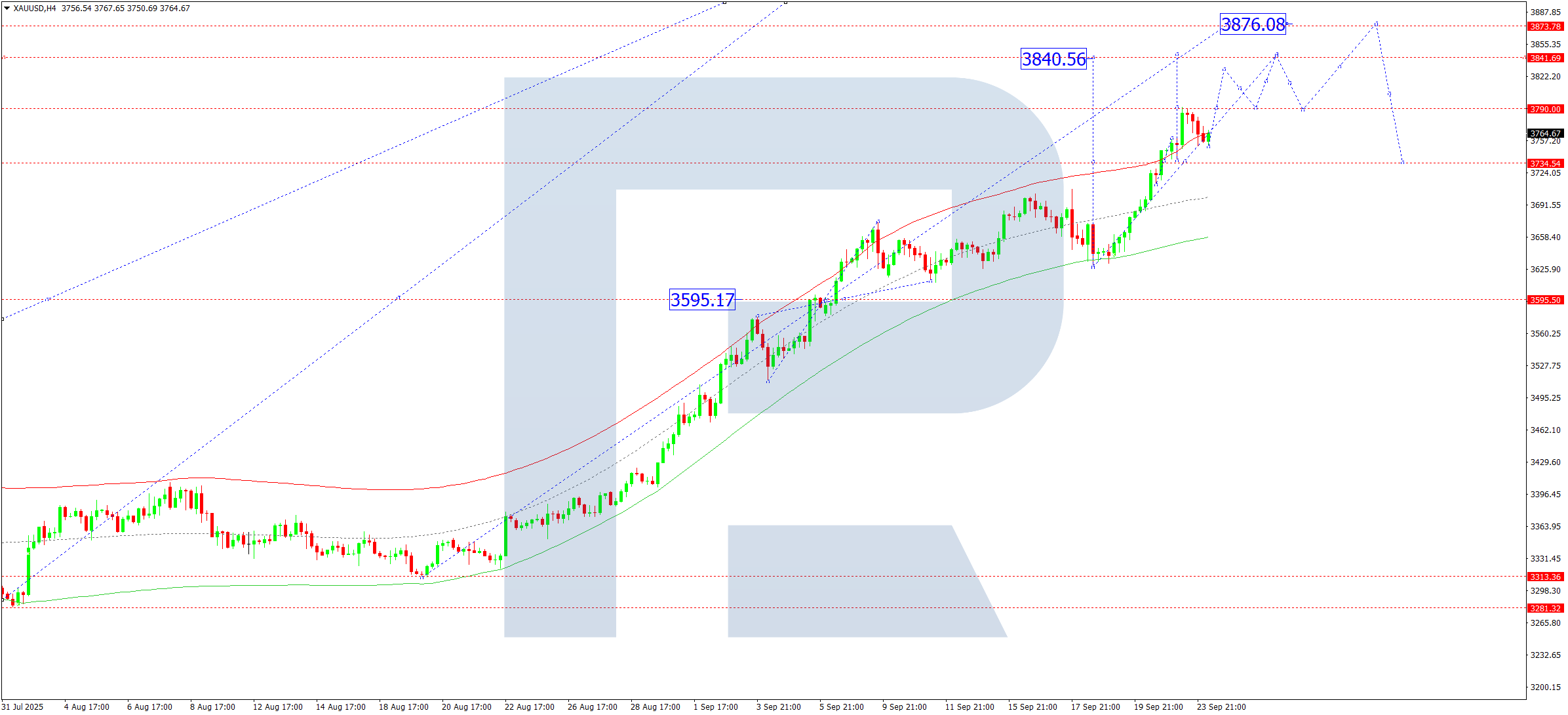

XAUUSD forecast

On the H4 chart of XAUUSD, the market rose to 3,790. Today, 24 September 2025, it corrected to 3,751 (testing from above) and started a new upward wave. A breakout of 3,790 and continuation to 3,840 is expected, with a local upward trend target at 3,878.

Technically, this scenario is confirmed by the Elliott wave structure and the upward wave matrix with a pivot at 3,595, which is considered key for XAUUSD. At the moment, the market is forming a growth wave towards the upper boundary of the Price Envelope at 3,878. Later, a correction towards the lower boundary at 3,737 is not excluded.

Technical indicators for today’s XAUUSD forecast suggest growth to 3,840.

Brent forecast

On the H4 chart of Brent, the market rose to 66.50 and, after breaking this level, extended to 67.44. Today, 24 September 2025, a decline to 66.55 (testing from above) is not excluded, followed by growth to 67.67. Overall, the market continues to form a wide consolidation range around 66.55.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 66.55, which is considered key in the structure for Brent. At the moment, the market reached the lower boundary of the Price Envelope at 65.41. Later, a correction towards the upper boundary at 67.67 is possible.

Technical indicators for today’s Brent forecast suggest considering growth to 67.67, followed by a decline to 64.66.