A decline in US consumer confidence may weigh on the US dollar and propel Brent prices towards 66.50 USD. Find more details in our analysis for 29 April 2025.

Brent forecast: key trading points

- Brent crude oil prices continue to correct

- The CB US Consumer Confidence Index: previously at 92.9, projected at 87.7

- Brent forecast for 29 April 2025: 63.00 and 66.50

Fundamental analysis

Fundamental analysis for Brent for today, 29 April 2025, considers that prices are declining, trading below 64.00 USD per barrel. The correction is primarily driven by renewed tensions in US-China trade relations.

The US Consumer Confidence Index from CB is forecast to drop significantly to 87.7 points from the previous 92.9. A decline in consumer confidence could negatively impact the US dollar.

Overall, the forecast for Brent remains positive, with prices likely to resume their upward trajectory after completing the correction.

Brent technical analysis

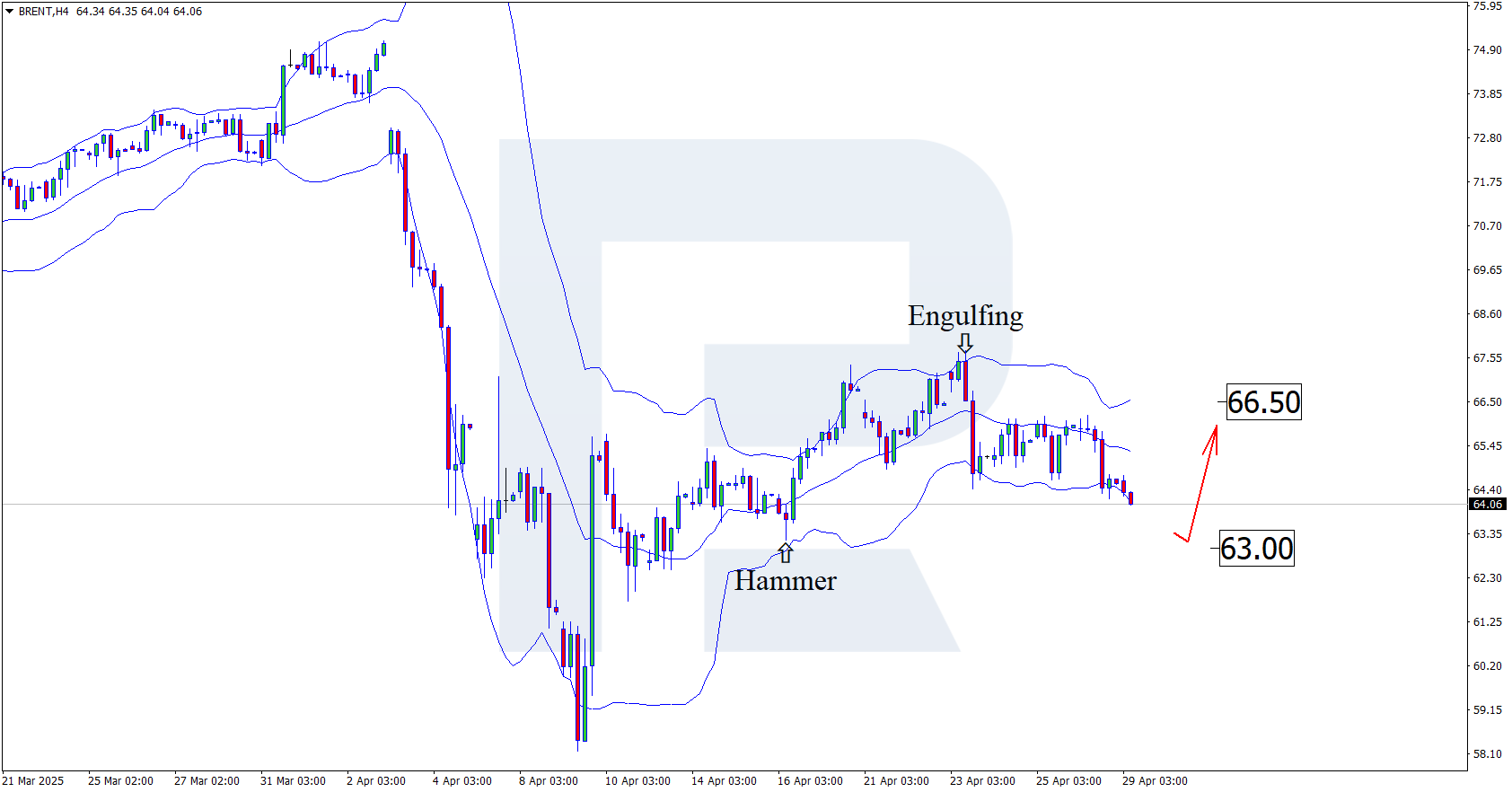

Having tested the upper Bollinger band, Brent prices have formed an Engulfing reversal pattern on the H4 chart. Currently, the quotes continue a downward wave following the pattern signal.

The Brent forecast for 29 April 2025 suggests a target for the correction at 63.00 USD. A rebound from the support level will pave the way for a more substantial upward movement.

Alternatively, there is a scenario where Brent quotes could climb to resistance at 66.50 USD without testing the support level.

Summary

Tensions between China and the US, combined with today’s Brent technical analysis, suggest a price correction towards 63.00 USD before a potential rise.